Bond Investor Information

OVERVIEW

Prince William County may issue debt for purposes of acquiring or constructing capital assets including land, building, equipment, and any other eligible expenses of the project and for making renovations to existing capital. As stated in County's Principles of Sound Financial Management, the County will consider the project and its useful life and utilize the most appropriate method to finance the project. Tax supported bonds will, whenever feasible, be issued on a competitive basis unless market conditions or the nature of the financing favors negotiated sales. General Obligation (GO) bond issues, and whenever possible for any type of annual appropriation debt, will be structured to allow an equal principal amount to be retired each year over the life of the issue thereby producing a total debt service with an annual declining balance. Prince William County will not use debt financing to fund current operations. Typically, the County issues bonds with maturities up to 20 years. Debt service for each issue will be structured to minimize the County’s interest payments over the life of the issue while considering the existing debt obligations of the County. Any debt issued shall not have a maturity date beyond the useful life of the asset being acquired or constructed by the debt proceeds. As market opportunities arise, the County may refund certain maturities of its bonds, if the refunding is expected to deliver savings. If the County is to pursue execution of refunding bonds, the transaction would be a separate series from the new money bonds. It is important to note that a refunding issuance does not extend the pay-off horizon of the outstanding County's obligations.

- DEBT OBLIGIATIONS SUMMARY

As of FY 2023, the total debt portfolio of Prince William County is comprised of $1.014 billion worth of GO, Revenue, Certificate of Participation and Lease Revenue Bonds.

Composition of Debt Outstanding (Total FY 2023 $1.014B)

ImageThe majority of the County's bonds are general obligations and are secured by its full faith and credit. Except for General Obligations (GO) issued through Virginia Public School Authority (VPSA), a referendum must be approved by the voters prior to the issuance of new money general obligation bonds. From time to time, the County may issue bonds that are subject to appropriation. In these instances, the County will work with a conduit issuer like the Industrial Development Authority of Prince William County (IDA).

- BOND RATINGS

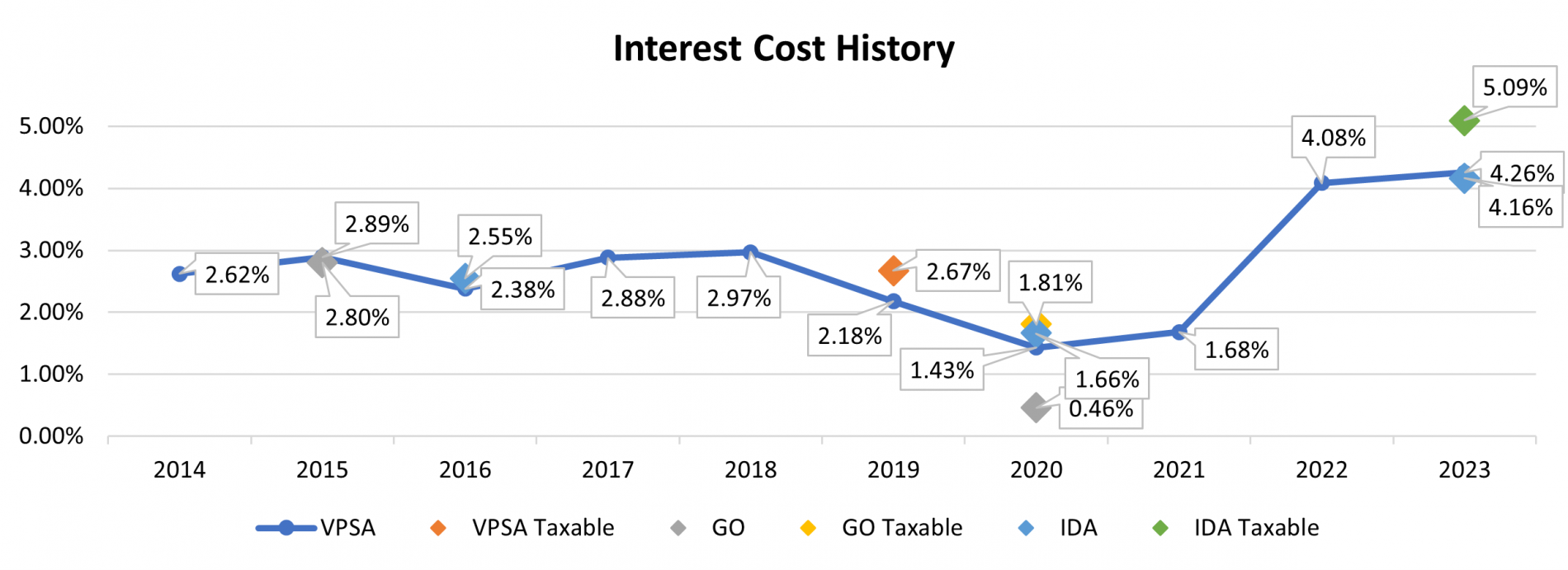

As stated in Prince William County' Principles of Sound Financial Management, the County will maintain a high credit rating in the financial community to: 1) assure the County's taxpayers that the County government is well managed and financially sound; 2) obtain reduced borrowing costs. The interest cost history is shown below:

Image

The County was upgraded to AAA by Fitch Rating in 2004, by Moody's Investors Service in 2010 and by Standard & Poor's in 2011. Prince William County’s AAA bond ratings from all three major rating agencies were reaffirmed for the October 2025 Bond Sale. Prince William County is one of only 54 Counties in the entire nation which has achieved top ratings from all three agencies; and including states and cities, Prince William County is one of only 88 jurisdictions nationwide with this prestigious designation.

- Fitch Report

- Moody's Report

- Standard & Poor's Report

- DEBT MANAGEMENT POLICIES

To ensure that debt does not unduly burden taxpayers of the Prince William County or pose a risk to the County’s credit ratings and overall credit worthiness, the Board of the County Supervisors has established self-imposed limits on the County's total bonded debt. Tax supported debt should not exceed 3% of the assessed valuation of taxable property in the County and debt service should not exceed 10% of annual governmental revenues, including County's component units.

The following charts show County's distribution of existing debt service and reflect County's ability to maintain self-imposed debt ratios. Both ratios remain below the County’s debt service policy limits. County staff analyze the potential impact of financing for projects in the Capital Improvement Plan against these two policy measures.

ImageImage - BOND INVESTOR INFORMATION AND OFFICIAL STATEMENTS

The County shall comply with all U.S. Internal Revenue Service rules and regulations regarding issuance of tax-exempt debt, including arbitrage rebate requirements for bonded indebtedness, and with all Securities and Exchange Commission requirements for continuing disclosure of the County’s financial condition. The County shall comply with all requirements of the Public Finance Act as included in Title 15.2 of the Code of Virginia and other legal requirements regarding the issuance of bonds and certificates of the County or its debt issuing authorities to meet the disclosure needs of rating agencies, underwriters, investors, and taxpayers.

Official Statements

The Finance Department, per statutory requirement, produces an Official Statement in support of Prince William County’s bond issuances. This document contains complete details of the bond issue, as well as comprehensive information about Prince William County, its citizens, and its governance. Information regarding debt issued by Prince William County may be found at the County's issuer page of the Municipal Securities Rulemaking Board's website.

Recently Completed Bond Sales:

Name and Purpose Date Par PRINCE WILLIAM COUNTY FACILITIES REVENUE BONDS, SERIES 2024A (TELEGRAPH ROAD PROJECT)

to finance construction of certain capital improvement projects (federally taxable)11/14/2024 $14,890,000

SPECIAL OBLIGATION SCHOOL FINANCING BONDS, PRINCE WILLIAM COUNTY SERIES 2024

to finance construction of various capital school improvement projects10/31/2024 $133,940,000 SPECIAL OBLIGATION SCHOOL FINANCING BONDS, PRINCE WILLIAM COUNTY SERIES 2023

to finance construction of various capital school improvement projects

11/09/2023 $135,815,000 PRINCE WILLIAM COUNTY FACILITIES REVENUE BONDS, SERIES 2023B (COUNTY FACILITIES PROJECTS)

to finance construction of certain capital improvement projects (federally taxable)

10/25/2023 $16,380,000 PRINCE WILLIAM COUNTY FACILITIES REVENUE BONDS, SERIES 2023A (COUNTY FACILITIES PROJECTS)

to finance construction of certain capital improvement projects

10/25/2023 $32,800,000 SPECIAL OBLIGATION SCHOOL FINANCING BONDS, PRINCE WILLIAM COUNTY SERIES 2022

to finance construction of various capital school improvement projects

11/10/2022 $42,400,000 SPECIAL OBLIGATION SCHOOL FINANCING BONDS, PRINCE WILLIAM COUNTY SERIES 2021A

to finance construction of various capital school improvement projects

10/21/2021 $58,855,000 FACILITIES REVENUE AND REFUNDING BONDS, SERIES 2020A (COUNTY FACILITIES PROJECT)

to finance construction of certain capital improvement projects and refinance certain maturities of the County's Park Facilities Revenue Bonds, Series 2010, for debt service savings

10/29/2020 $49,580,000 SPECIAL OBLIGATION SCHOOL FINANCING BONDS, PRINCE WILLIAM COUNTY SERIES 2020

to finance construction of various capital school improvement projects

10/15/2020 $106,510,000 TAXABLE GENERAL OBLIGATION PUBLIC IMPROVEMENT REFUNDING BONDS, SERIES 2020B

to refinance certain maturities of the County's GO bonds issued both directly or through VPSA for debt service savings

6/18/2020 $72,220,000 GENERAL OBLIGATION PUBLIC IMPROVEMENT REFUNDING BONDS, SERIES 2020A

to refinance certain maturities of the County's GO bonds issued both directly or through VPSA for debt service savings

6/18/2020 $24,465,000 INDEPENDENT REGISTERED MUNICIPAL ADVISOR (IRMA) EXEMPTION LETTER

FINANCIAL DOCUMENTS