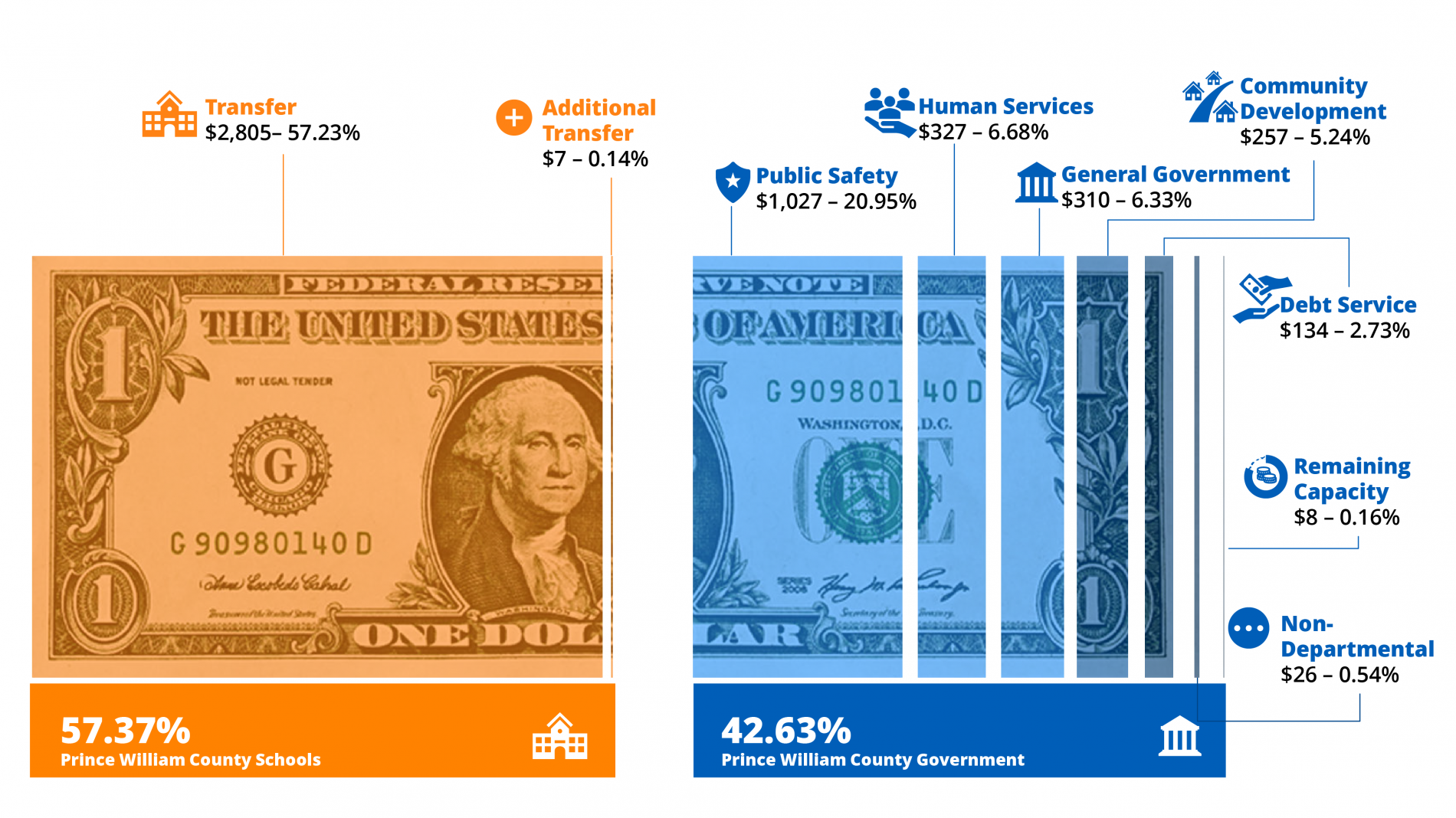

The Proposed FY2023 Budget and presentation was presented to the Board of County Supervisors on Tuesday, February 15, 2022, during the 7:30 PM Board meeting. The budget is based on many revenue sources, one of which is a $1.050 real estate tax rate, generating general revenues of $1,252,644,000. Of that revenue, the Schools and the County split in accordance with the revenue sharing agreement. The average residential tax bill based on that tax rate is $4,901. The following infographic shows the services that the average tax bill funds by functional areas. Information about the budget is available in its entirety or by section in the expandable list below.

- Understanding the Budget

INTRODUCTION

Acknowledgements, GFOA, Table of Contents, Organization Chart, Transmittal Letter, Budget Highlights, and Budget Initiatives

BUDGET DEVELOPMENT PROCESS

State Budget Requirements, Components of the PWC Budget, and Policies & Practices for Budget Preparation

BUDGET SUMMARY

Revenue vs. Expenditure, Five-Year Budget Plan, and FY2023 Personnel (FTE) Summary

COMPENSATION

Attracting and Retaining Quality County Employees

AGENCY PAGE INFORMATION

Functional Areas and Agency PagesCOMMUNITY PARTNERS

Funding Provided to Community PartnersCAPITAL IMPROVEMENT PROGRAM

CIP Summary, Community Development, General Government, Public Safety, Technology Improvement, and Transportation Capital ProjectsAPPENDIX

Glossary and Abbreviations - Community Development

Average Tax Bill: Community Development accounts for $257 and 5.24% of the average residential tax bill in FY23.

- General Government

Average Tax Bill: General Government accounts for $310 and 6.33% of the average residential tax bill in FY23.

- Human Services

Average Tax Bill: Human Services accounts for $327 and 6.68% of the average residential tax bill in FY23.

- Area Agency on Aging

- Community Services

- Housing & Community Development

- Public Health

- Social Services

- Virginia Cooperative Extension

- Public Safety

Average Tax Bill: Public Safety accounts for $1,027 and 20.95% of the average residential tax bill in FY23.

- Adult Detention Center

- Circuit Court Clerk

- Circuit Court Judges

- Commonwealth's Attorney

- Criminal Justice Services

- Fire & Rescue

- General District Court

- Juvenile Domestic Relations Court

- Juvenile Court Service Unit

- Magistrates

- Police

- Public Safety Communications

- Sheriff's Office

- Non-Departmental

Average Tax Bill: Non-Departmental accounts for $26 and 0.54% of the average residential tax bill in FY23.

- Debt Services

Average Tax Bill: Debt Services accounts for $134 and 2.73% of the average residential tax bill in FY23.

Capital Improvement Program

CIP Summary, Community Development, General Government Public Safety, Technology Improvement, and Transportation Capital Projects

Budget Calendar

Stay up to date with upcoming budget meetings and events.